Be in command of the way you expand your retirement portfolio by using your specialised information and pursuits to invest in assets that in shape using your values. Bought knowledge in housing or personal equity? Use it to guidance your retirement planning.

An SDIRA custodian differs simply because they have the suitable staff members, knowledge, and potential to keep up custody of your alternative investments. The initial step in opening a self-directed IRA is to locate a provider that may be specialised in administering accounts for alternative investments.

A self-directed IRA is really an very strong investment automobile, but it surely’s not for everybody. As the stating goes: with good ability will come terrific responsibility; and with an SDIRA, that couldn’t be a lot more real. Continue reading to know why an SDIRA could, or may not, be for you.

Greater investment possibilities suggests you could diversify your portfolio further than stocks, bonds, and mutual funds and hedge your portfolio versus sector fluctuations and volatility.

Often, the costs connected with SDIRAs may be bigger plus much more intricate than with a regular IRA. It's because in the increased complexity connected to administering the account.

Limited Liquidity: Many of the alternative assets that may be held in an SDIRA, like property, private fairness, or precious metals, will not be quickly liquidated. This may be a problem if you need to accessibility funds immediately.

This contains knowledge IRS restrictions, taking care of investments, and averting prohibited transactions that could disqualify your IRA. A lack of knowledge could end in high-priced faults.

Shopper Assistance: Seek out a company that offers devoted help, like use of well-informed specialists who can response questions about compliance and IRS click to read more policies.

Entrust can next support you in acquiring alternative investments with your retirement cash, and administer the shopping for and offering of assets that are generally unavailable by financial institutions and brokerage firms.

Ahead of opening an SDIRA, it’s imperative that you weigh the probable advantages and disadvantages based upon your particular fiscal goals and threat tolerance.

Have the liberty to invest in Pretty much any kind of asset that has a hazard profile that matches your investment tactic; which include assets that have the prospective for a greater price of return.

Put basically, if you’re trying to find a tax successful way to build a portfolio that’s additional tailor-made towards your interests and know-how, an SDIRA could possibly be The solution.

As an investor, having said that, your options usually are not limited to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can transform your portfolio.

Quite a few investors are stunned to learn that applying retirement cash to invest in alternative assets has been probable due to the fact 1974. Even so, most brokerage firms and banking institutions focus on presenting publicly traded securities, like stocks and bonds, because they absence the infrastructure and expertise to control privately held assets, such as real estate property or non-public equity.

Opening an SDIRA can present you with access to investments Generally unavailable via a bank or brokerage agency. In this article’s how to begin:

Contrary to shares and bonds, alternative assets are sometimes harder to promote or can come with demanding contracts and schedules.

In case you’re trying to click for source find a ‘established and forget about’ investing approach, an SDIRA almost certainly isn’t the proper preference. Simply because you are in complete control about every investment manufactured, it's up to you to carry out your individual homework. Remember, SDIRA custodians usually are not fiduciaries and cannot make suggestions about investments.

The most crucial SDIRA procedures with the IRS that traders need to be familiar with are investment constraints, disqualified persons, and prohibited transactions. Account holders ought to abide by SDIRA policies and regulations so that you can preserve the tax-advantaged position of their account.

Complexity and Duty: With the SDIRA, you have got a lot more Command more than your investments, but you also bear more obligation.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Robbie Rist Then & Now!

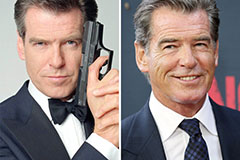

Robbie Rist Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!